WHAT IS GST RETURN FILING

The basic meaning of “GST Return Filing” is “maintaining financial accounts” per year. Bookkeeping and GST Return Filing can be divided into several fields including financial GST Return Filing, managing general GST Return Filing,professional GST Return Filing, chartered accountant, auditing, tax GST Return Filing and cost GST Return Filing.

Step 1: Connect with an expert at LegalDocs and provide the necessary information to prepare your gst filing statement.

Step 2: Our expert will prepare a GST return statement based on the information provided and send it to you for your approval.

Step 3: GST return will be filed with the tax authorities once it has been approved by you.

Order Now

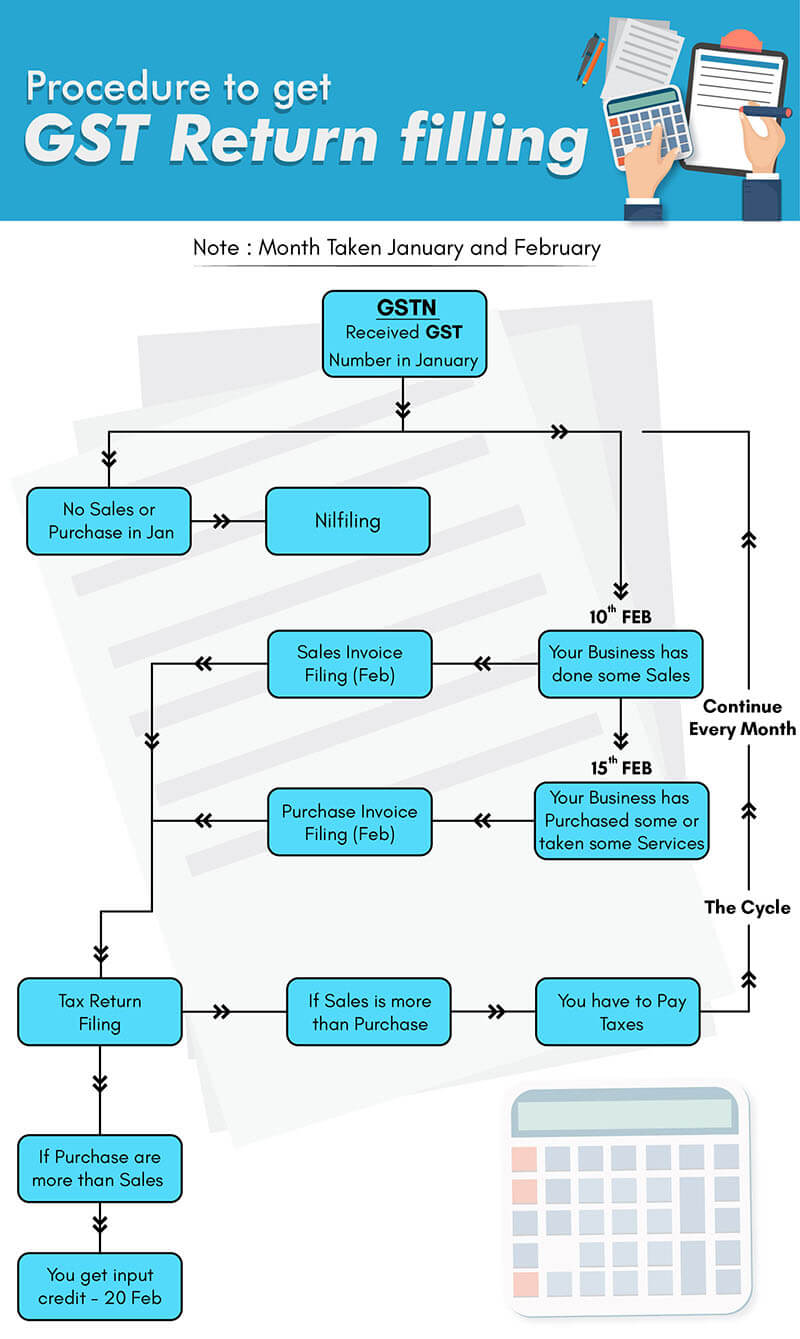

PROCESS FOR GST RETURN FILING SERVICES ONLINE

Step 1: our must first file for GSTR-1 (for sales made) by the 10th of each month.

Step 2: The buyer views (and rectifies, if any) the sales made by you in GSTR-2A.

Step 3: The buyer then approves the sale made by you and files for GSTR-2 by the 15th of each month.

Step 4: If any modifications are made, you (the seller) can approve or reject the same in GSTR-1A.

Step 5: When both the seller and buyer approve of the forms, GSTR-3 is generated with the payment of taxes due by the 20th of each month.

WHAT IS GST RETURN

A GST file return is a document which has details of income which a taxpayer needs to file with the tax administrative authorities. This is used by tax authorities to calculate tax liability.

ELIGIBILITY FOR GST RETURN FILING

In the GST norms, any regular business has to file three monthly returns and one annual return.

GST should also be filed by entities that make no sales or purchases during a given period (year) in the form of nil-returns (meaning no returns).

The best part in this system one has to manually enter details of one monthly return – GSTR-1. The other two returns – GSTR 2 & 3 will get auto-populated by deriving information from GSTR-1 filed by you and your vendors. Compounding taxpayers have to file returns quarterly which is for every three months and regular taxpayers such as, foreign non-residents, casual taxpayers and Input Service Providers (ISD) have to file returns monthly.

Frequently Asked Questions

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Fugit vitae

eum animi iure necessitatibus repudiandae?

Web hosting is service that enables you to upload and store your websites HTML and related files on a web server.

Linux uses OpenSource. While Windows runs on the propitiatory source code. Both Linux and Windows Shared Hosting are used for hosting websites using a CMS (WordPress, Joomla, etc.) or using your custom code. Choose Windows Shared Hosting if your site requires ASP, ASP.NET, MS SQL or IIS. For every other kind of site, Linux Shared Hosting would be the recommended product.

In Shared Hosting, multiple websites are hosted on a single server i.e. the websites share the servers resources. This helps reduce the cost, since the cost of the server and its resources are spread across multiple packages hosted on the server.

Yes, you need a domain name to buy web hosting. In case you do not own a domain name, you can purchase the same during the web hosting purchase flow with HostGator India.

It is recommended that you keep copies of your website files and database. You can get regular backup of your website with the help of CodeGuard backup solution.

It is very good Services